Table of Content

State Farm quoted us an annual premium of $1,003, which is less than the national average of $1,272 but slightly higher than the $943 average in Pennsylvania where we received our quote. We at the Guides Home Team have spent 40+ hours analyzing the top home insurance providers in the industry, and we think these companies are the best choices for most homeowners. Homeowners insurance protects your most expensive possession, covering the costs to rebuild the structure of your home or replace your belongings. Homeowners insurance, also called home insurance, goes hand in hand with homeownership.

You'll be able to search if your doctors and prescriptions are listed as part of the plan you select. But keep in mind, doctors can change what insurance they accept, so it's always best to check with your doctor directly to make sure you're covered. No matter what work brings you, Catch has freelancer benefits that save you time and keep you from falling behind.

Get back to making money, not managing it.

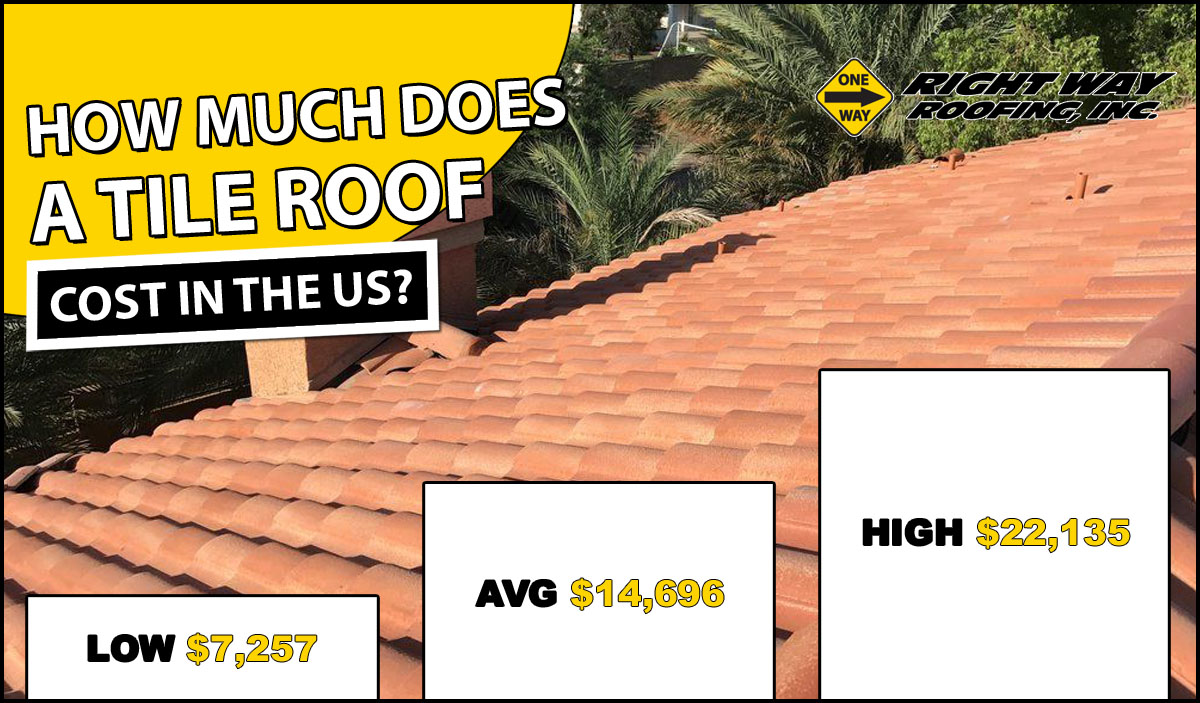

You’ll want to consider cost factors like the age of the home and the material it is made up with, including the wiring, plumbing and heating systems. California, Maryland and Massachusetts don’t allow insurance companies to use credit as a factor in homeowners insurance rates. Some homeowners insurance companies offer discounts for houses with storm shutters and impact-resistant glass on exterior windows. It pays for injuries or property damage you accidentally do to others—for example, if your child accidentally throws a football through a neighbor’s window. It also covers legal fees and court judgments or settlements if you’re sued over to an accidental incident.

We are together, bound in a life cycle, to help save marine life from plastics. Remember if we don’t stop, Our children might cruise on the ocean full of plastic. Giving your dog a safe outdoor space is a great way to give them exercise and fun. Considering the floor when designing an outdoor dog walk is essential, as it can affect the ease of cleaning and save your dog from extreme weather. These short striking phrases can go a long way if you’re trying to get in the workout zone.

Auto Insurance Slogans

Fire, theft, vandalism, smoke and personal injury will usually be covered. Earthquakes and flooding are not covered with most standard plans, but many companies offer protection for these events as an add-on. If you live in an area prone to natural disasters like hurricanes or earthquakes, home insurance will cost more than in areas that are typically safe from these catastrophes. If your perceived risk is too high, you can even be denied coverage by some providers.

Progressive offers its own home insurance but also places customers with other companies it has arrangements with. The rates we show are through American Strategic Insurance —which is part of Progressive—but you could be quoted a rate from a partner company. Is one of the best ways to save on both policies’ premiums, since companies that offer both products typically provide considerable discounts for purchasing them together.

Common Home Insurance Discounts

The insurer will reward you for having a new roof, bundling your home and auto policies, purchasing your insurance policy online and more. Its industry-leading financial strength allows it to take on more risk. Further, its online tools and straightforward quote process help first-time homeowners find a policy that matches their unique risks. Your homeowners insurance policy isn’t just for the building you live in. It also covers your personal belongings for named perils such as fire, windstorms, theft and vandalism. There are often sub-limits of $1,500 to $5,000 assigned to valuable items, such as jewelry, furs, collectibles and original art.

We make money by holding your money and from helping you get health insurance and other benefits if you need them. Check out the table below to find out which home insurance providers offer the best discounts for bundling home and auto lines of coverage. While a dog may be a man’s best friend, yours could be at odds with your property insurer. A standard policy typically covers the damage caused by some dogs, but many insurers exclude specific pets with a history of biting or even exclude entire breeds. Providers that institute a banned breed list refuse coverage for certain historically aggressive breeds, such as pit bulls and rottweilers, no matter how cute your companion is. Consider finding an insurer that doesn’t ban animals or working with an agent to find a policy that meets your needs and your dogs.

Additional site navigation

When choosing a home insurance provider and policy, there are a few steps you’ll want to take to make sure you get the best one for your needs. ‘s convenience and affordable rates along with Allstate‘s national availability, extensive experience in the market and wide range of discount offerings. We went through a local agency in Pittsburgh and received a quote for $1,017 for the year. While slightly above the average premium in Pennsylvania, it’s below the national average of $1,272. You’ll also want to think about other factors, such as extreme weather conditions like hail and tornadoes.

Join our free newsletter to get unlimited access to all startup data including startup costs. We have seen countless Starter Story readers join us, get inspired, and change their lives through the businesses they’ve built. Our goal is to show you that building the business of your dreams is not only possible, but it’s quite straightforward once you see how others have done it. Based on data points from our 4,254 case studies, you'll find the 201 most effective ways that founders are growing their business right now. You’ll learn how thousands of ordinary people built businesses to millions in revenue - all starting from a simple idea or side project.

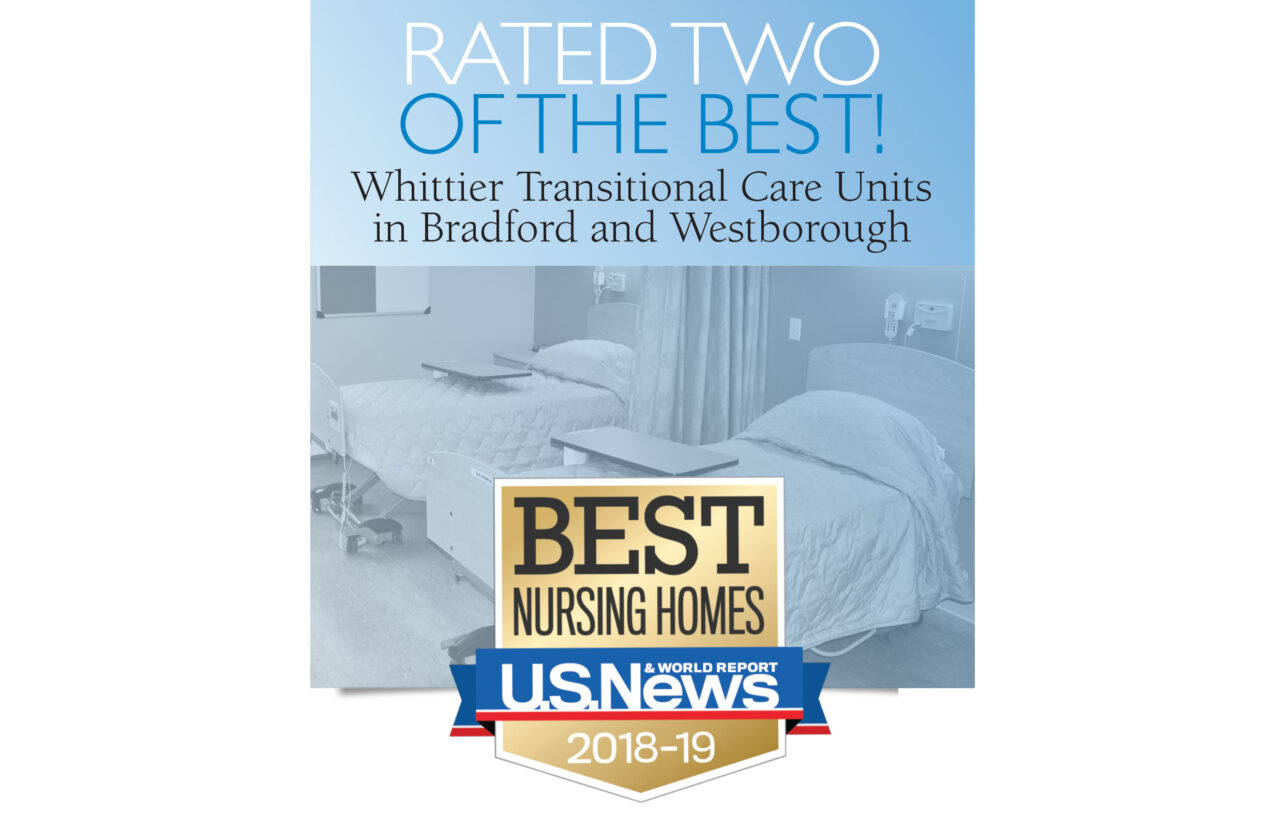

Over the past 90 years, Allstate has earned a Superior rating from AM Best and has become a stable insurer with the spending power to pay out claims from high-risk customers. Competitive coverage options include a wide range of deductibles and impressive discounts for bundling home and auto policies. Amica is a top insurance company offering comprehensive coverage and accessible customer service through its website and mobile app. Amica also offers a fast and easy quote process, and a few easy ways to save, such as opting into paperless billing and autopay or selecting the dividend policy.

Its comprehensive homeowners insurance policies include customizable coverage for your personal property and liability coverage. Allstate also has a home value estimation tool on its website that helps homeowners determine how much dwelling coverage they may need. Nationwide is a top insurer that offers a variety of insurance policies, including home, auto, life and even your wedding. Power are indicative of Nationwide’s financial strength and customer satisfaction. The provider also offers a free annual review of your existing policy to make sure it always covers your evolving needs. Progressive came in as the cheapest homeowners insurance company nationwide with an average rate of $1,236.

Sarah made sure I was getting all the savings I was eligible for on health insurance. Industries, markets, and trends - you’ll get access to the world’s biggest, living, breathing database of 8,465 business ideas, side projects, and products to sell. We've put together 1,000+ catchy and best insurance slogans & taglines + a step-by-step guide on how to come up with a powerful slogan for your brand. This slogan category aims to stop people from using plastic, be it in the form of plastic bags or some plastic packaging material.